According to Morningstar, which cited share market analysts, investors may have to contend with the largest bear market since the Great Depression, which might lead to a 1929-style Great Wall Street crash in the US stock market.

According to U.S. stock market specialist Jon Wolfenbarger, there are a few things that could push Wall Street in the wrong directions. These include current market attitude, rising debt levels, economic fragility, a lack of effective policy instruments, global economic uncertainty, and Donald Trump's tariffs.

Andrew Ross Sorkin, a financial writer and author, has forecast a U.S. stock market catastrophe based on indicators of a bubble, overbuying, and the relaxation of banking restrictions. Kristalina Georgieva, the head of the IMF, has issued a warning about the detrimental effects of AI.

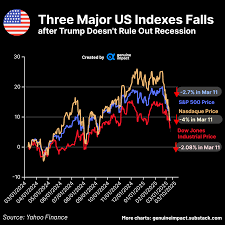

Wall Street saw significant volatility as U.S. President Donald Trump threatened to impose additional tariffs on China. However, after Trump stated that such high tax rates are unsustainable, the anxiety subsided somewhat.

The banking sector is another area of concern for Wall Street that seems to be abating. Following two banks' warnings last week about possibly risky loans they had made, stocks of smaller and midsized banks rose Monday, regaining some of their losses.

The revelations have sparked debate over whether the mounting list of issues is merely a collection of isolated incidents or a symptom of a bigger issue that could endanger the sector as a whole.

Wall Street saw significant volatility as U.S. President Donald Trump threatened to impose additional tariffs on China. However, after Trump stated that such high tax rates are unsustainable, the anxiety subsided somewhat.

The banking sector is another area of concern for Wall Street that seems to be abating. Following two banks' warnings last week about possibly risky loans they had made, stocks of smaller and midsized banks rose Monday, regaining some of their losses.

The revelations have sparked debate over whether the mounting list of issues is merely a collection of isolated incidents or a symptom of a bigger issue that could endanger the sector as a whole.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)